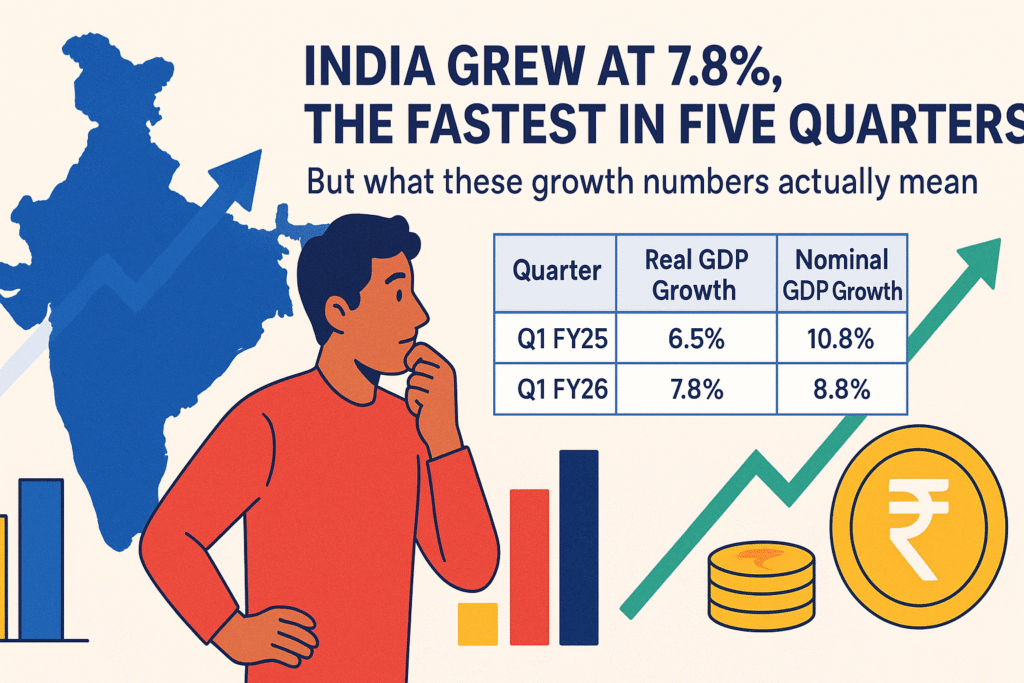

Nominal vs Real GDP: Two Sides of the Same Coin

GDP represents the total value of goods and services produced by a country. But it comes in two main flavours:

- Nominal GDP measures growth including inflation — that is, how much the money value of the economy has expanded.

- Real GDP removes the effect of inflation to show how much actual production of goods and services grew.

For Q1 of FY25 and FY26, the numbers appear as follows:

| Quarter | Real GDP Growth | Nominal GDP Growth |

|---|---|---|

| Q1 FY25 | 6.5% | 10.8% |

| Q1 FY26 | 7.8% | 8.8% |

Notice a divergence — real GDP growth rose sharply while nominal growth slowed down. Under typical circumstances, both tend to move broadly together.

The Role of the GDP Deflator

The key to this puzzle is the GDP deflator, a measure that adjusts nominal GDP for inflation. It tells us how much of GDP growth is due to rising prices rather than increased output.

Think of this as a price correction:

- Imagine you spent ₹1,000 last year and ₹1,200 this year.

- If all extra ₹200 was just price increases, your actual consumption remained the same.

- The deflator separates the part of growth due to inflation from true volume growth.

In Q1 FY26, India’s deflator was extremely low — near 1%, one of the lowest in recent years. This low inflation adjustment inflates the real GDP growth figure.

Why Is the Deflator So Low?

The deflator is based on a weighted mix of wholesale price index (WPI – 60%) and consumer price index (CPI – 40%). For this period:

- WPI hovered near zero, signalling little wholesale price inflation.

- CPI averaged roughly 2.7%, capturing consumer price increases.

However, WPI does not measure price changes in the services sector, which forms nearly two-thirds of India’s economy. Prices in services like education, healthcare, travel, and housing have been rising faster than wholesale goods prices, meaning the deflator understates real inflation.

Hence, many economists argue a more realistic deflator would be closer to 2%. If that were used, India’s real GDP growth rate for Q1 FY26 would fall to about 6.7% — still strong, but less eye-catching.

What Does This Mean for India’s Economic Performance?

The takeaway is clear: India is growing robustly, but the headline 7.8% real GDP growth partly reflects an unusually low inflation adjustment rather than purely a surge in production.

In practical terms:

- Official figure: 7.8% real GDP growth, fastest in five quarters.

- Adjusted estimate: Approximately 6.7% real growth accounting for more realistic inflation.

Both rates reflect healthy growth amid global uncertainties, but knowing the difference is vital for balanced expectations.

Why This Matters to Readers in India

Understanding these complexities helps investors, policymakers, and citizens interpret economic news with greater clarity:

- Investors: Accurate growth measures affect market sentiment and investment decisions.

- Policymakers: Inflation and growth metrics inform fiscal and monetary policies.

- Business and Consumers: Real economic health impacts employment, incomes, and living standards.

In Nutshell

India’s 7.8% real GDP growth in Q1 FY26 is a testament to its economic resilience and growth potential. Still, to understand the real pace of expansion, one must look beyond the headline and consider inflation adjustments and methodological nuances.