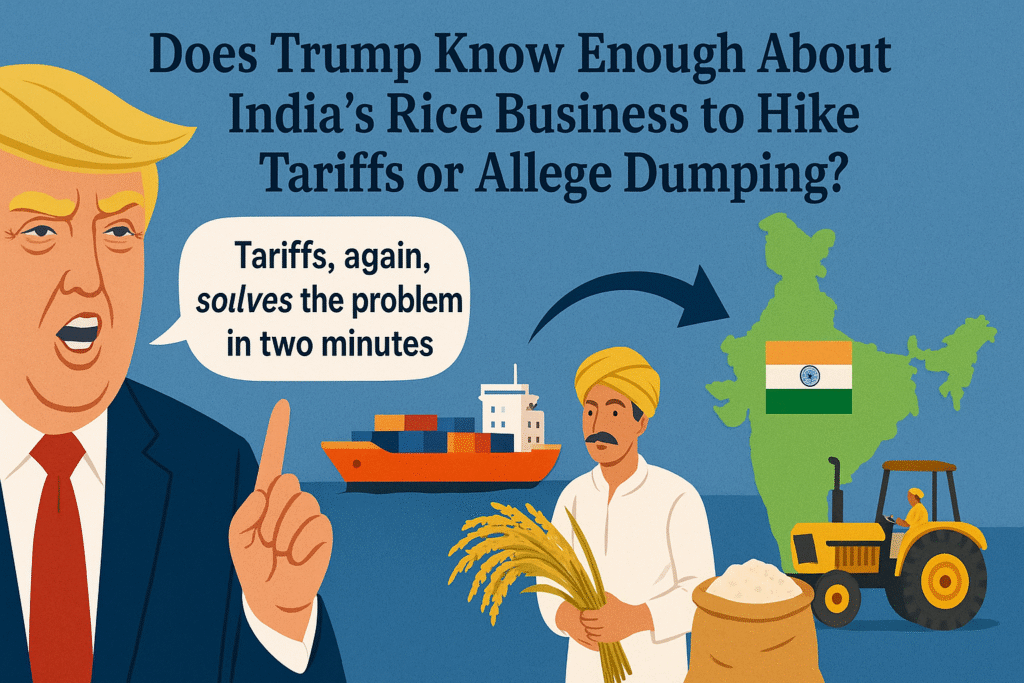

When Trump threatened fresh tariffs on Indian rice imports, the comments stirred alarm — not just among traders and farmers, but across entire supply chains. The blunt simplicity of his response — “Tariffs, again, solves the problem in two minutes” — belied a far more complicated reality. The question is: does that reality reflect what actually happens in India’s rice business, and does the US leader grasp it?

India’s Global Rice Dominance: The Bigger Picture

India remains a global powerhouse in rice — not just by cultivation, but by exports. In FY 2024-25, India exported about 20.1 million tonnes of rice, worth roughly US$ 12.95 billion, shipping to over 170 countries.

Estimates suggest that India accounts for around 40% of the world’s rice exports, underscoring its central place in global grain supply.

That dominance isn’t thanks to a narrow niche alone: both basmati and non-basmati rice varieties are shipped globally, and export patterns show wide diversification by destination.

For many importing countries — especially in West Asia and Africa — Indian rice remains a staple, meeting dietary needs and bridging food supply gaps.

This context matters. When a large share of world rice trade hinges on India, any policy shock affecting Indian exports could ripple across continents and disrupt markets globally.

The US Import Footprint: Small but Symbolic

In that vast web of global trade, the United States plays only a modest role as a buyer of Indian rice. In 2024, India shipped about 234,000 tonnes of rice to the US — a fraction of its total exports and a minor share even within India’s basmati shipments.

Given this, a US-targeted tariff — even a steep one — would likely inflict only a small dent in India’s overall rice volumes. That raises the question: Is the threat more symbolic, aimed at domestic US politics and farmers, than rooted in economic necessity?

It’s also telling that much of India’s rice goes to other regions — meaning the impact of any US tariffs could be blunted by redirecting shipments to other buyers, thereby protecting farmers and exporters from severe losses.

Allegations of ‘Dumping’: Too Simple a Narrative?

Trump’s justification rests on a familiar protectionist refrain — that Indian rice is being “dumped,” undercutting US farmers and distorting competition. Yet the statistics don’t clearly support a large-scale dumping scenario, at least not in purely volume-driven terms.

India’s global rice exports are large, but US imports are a tiny sliver.

Much of India’s rice trade is with regions — West Asia and Africa — where demand remains robust. This diversification makes a case that Indian exporters aren’t relying on the US as their main market, but on global demand.

India’s strong agricultural output: With recent bumper crops and improved yields, the country may be exporting more, but that speaks more to supply capability than aggressive dumping.

In short: the claim that India is “dumping” rice into the US market — enough to warrant sweeping tariffs — seems more like political rhetoric than trade-data driven reality.

The Real Impact: Who Stands to Lose — and Who Might Be Unfazed

If new tariffs go through, exporters serving the U.S. market could see a slump — at least short-term. But because the US makes up a small portion of India’s overall rice export basket, the broader damage could be limited.

Indian exporters have long cultivated diversified markets, and major buyers remain in West Asia and Africa, where demand continues to grow.

For U.S. consumers, however, the impact could be immediate — higher prices, reduced variety, and potential supply tightening, especially for imported basmati or specialty rice.

As for Indian farmers: the risk exists that repeated tariff threats could erode confidence, especially if export destinations shrink. But given current trends and production surplus, traders may simply pivot to other global markets.

So — Does Trump ‘Know Enough’? Probably Not

Given the data, it appears that the threat to India’s rice exports — and the claim of dumping — simplifies a far more complex trade ecosystem. India’s dominance in global rice trade, its diversified export markets, and its modest shipment volumes to the US suggest that sweeping allegations and tariffism lean heavily on politics rather than economics.

While it’s understandable that US farmers may push for protection, a blanket tariff on Indian rice seems disproportionate. A more reasoned approach would emphasise dialogue, targeted reforms, and mutually beneficial trade terms — not blunt, headline-grabbing threats that risk global supply chains and consumer welfare.

In short: before leaning on “tariffs again,” perhaps a deeper, data-driven conversation is overdue — one that reflects how India actually does business in rice, far beyond soundbites.