India’s tax system has just had its biggest facelift since 2017. The 56th meeting of the GST Council has delivered what many are calling GST 2.0 — a simplified, two-rate structure that slashes tax on hundreds of everyday items, trims compliance burdens, and promises to ease inflation for households.

Let’s break down what this means for you, your wallet, and the wider economy.

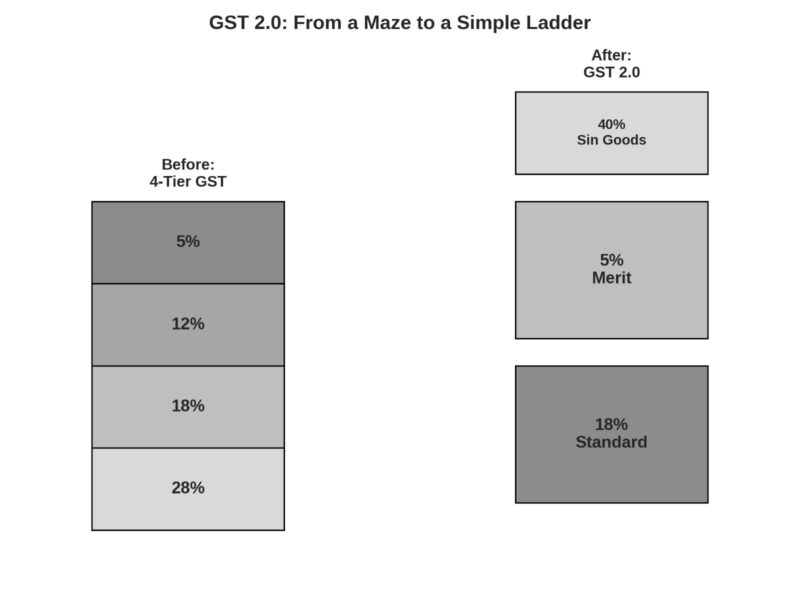

The Big Shift: From Four Rates to Two

Until now, GST was a maze of four rates (5%, 12%, 18%, 28%) with several exceptions. Now, the Council has collapsed this into:

- 5% “Merit Rate” – for essentials and mass-use goods

- 18% “Standard Rate” – for most other items

- 40% “De-merit Rate” – only for a few “sin goods” such as tobacco

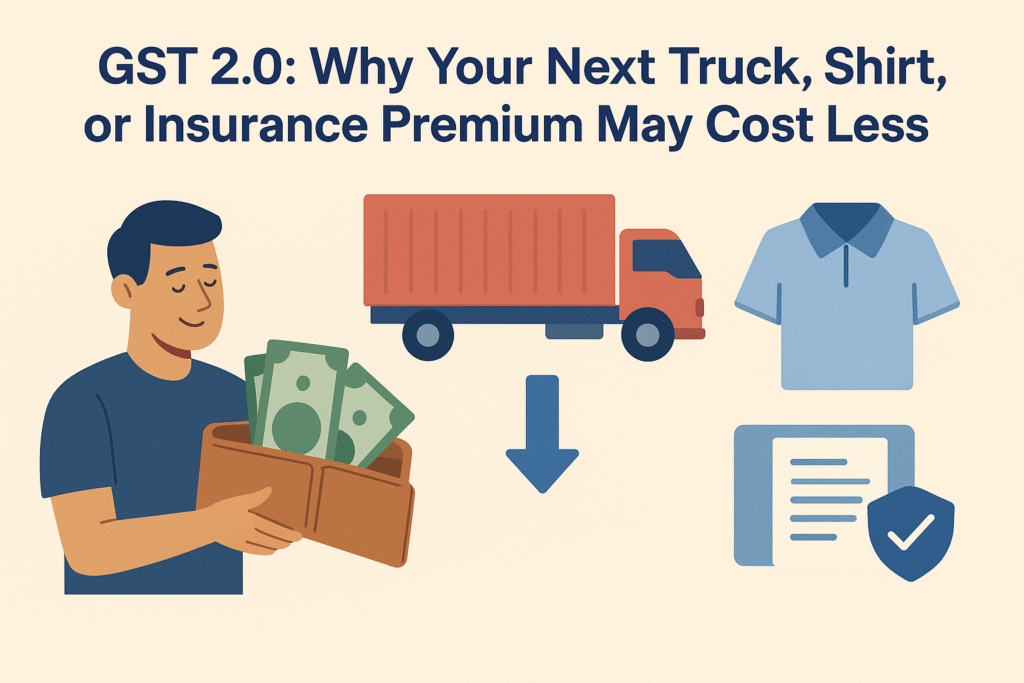

What Gets Cheaper?

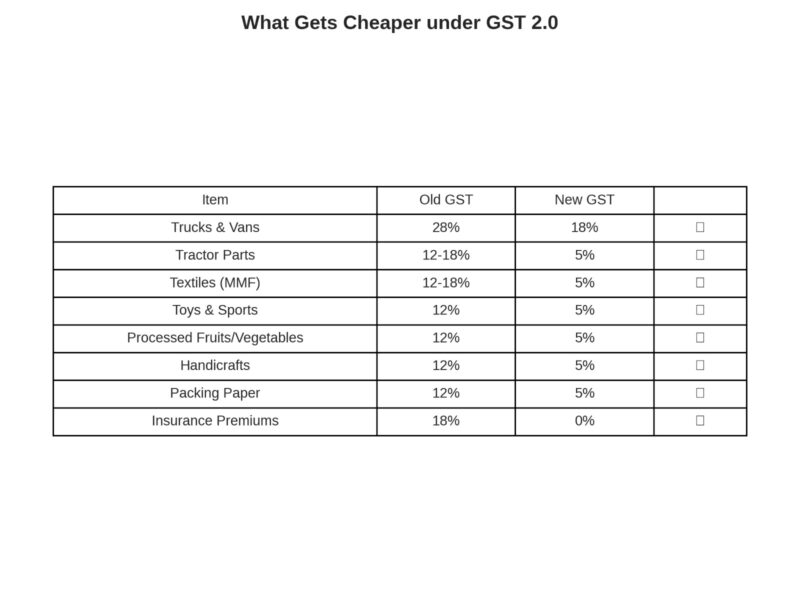

The Press Information Bureau and SBI Research together reveal that 453 items saw rate changes. Out of these, 413 items got cheaper, while only 40 went up. Nearly 295 goods now attract just 5% or NIL GST.

Everyday Goods and Services

From food to freight, GST cuts touch every corner of daily life.

Transport & Agriculture

- Commercial vehicles (trucks, vans): 28% → 18% → reduces freight cost, lowers inflation in FMCG and cement.

- Tractor parts: 12%/18% → 5% → big boost for India’s tractor hub and MSMEs making spares.

Textiles & Clothing

Man-made fibres & yarn: Earlier stuck in an “inverted duty” puzzle (fibre taxed higher than fabric), now aligned at 5%. Corrects distortions, reduces garment prices, and boosts exports.

Health & Insurance

Life and health insurance premiums: GST removed completely (from 18% to 0). Lower premiums, more affordable cover for households, and deeper penetration in the insurance market.

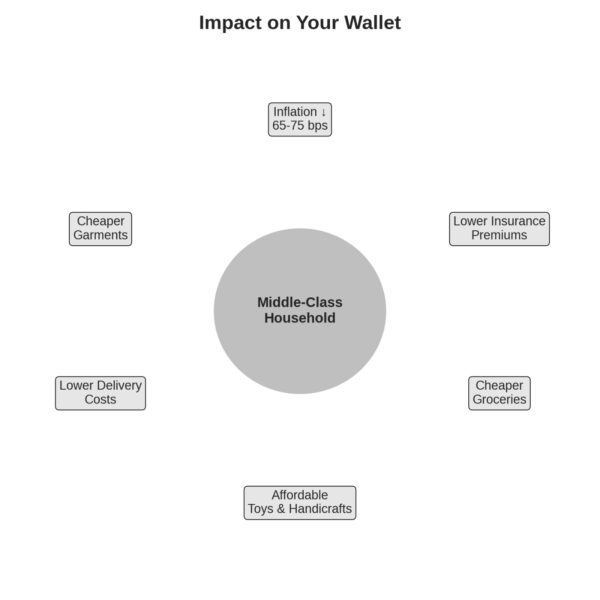

How Will It Hit Your Pocket?

Inflation relief and lower costs feed directly into middle-class savings.

According to SBI Research:

- Inflation relief: Headline CPI inflation could drop by 65–75 basis points over FY26–27. Food items alone may shave off 25–30 bps.

- Consumption boost: Middle-class households save more, spend more.

- Banking benefits: Banks save on insurance and infrastructure costs; more resources for customer services.

Impact on the Economy

Weighted average GST rate has fallen steadily since 2017, now down to 9.5%.

Weighted average GST rate has slid from 14.4% (2017) to 11.6% (2019), and now to just 9.5%.

Revenue impact: Govt estimates a ₹48,000 crore annual hit. But SBI projects a much smaller ₹3,700 crore net loss, thanks to higher consumption.

Exports & competitiveness: Lower logistics, textile, and processing costs sharpen India’s edge globally.

What Stays Costly?

Not everything is cheaper. Tobacco products (gutkha, cigarettes, chewing tobacco) remain under 40%+ cess, with no relief in sight. States will also continue levying excise on alcohol.

Why It Matters: GST 2.0 is More Than a Tax Cut

For the consumer: groceries, garments, insurance, and even toys get lighter on the wallet.

For businesses: lower compliance, cheaper logistics, higher competitiveness.

For the government: a more buoyant, wider tax base instead of chasing short-term revenue.

In short, GST 2.0 isn’t just a fiscal tweak. It is a structural reset aimed at simplifying taxes, boosting growth, and cooling inflation — while making everyday life a little easier.